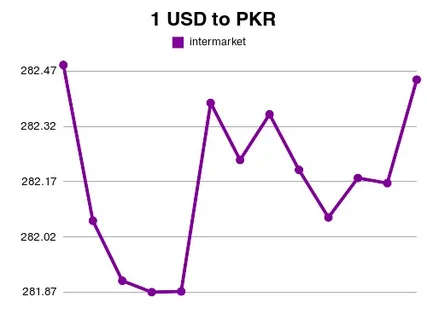

1 USD to PKR – Dollar Exchange Rate Movement Explained

The exchange rate between the US Dollar (USD) and the Pakistani Rupee (PKR) is more than just a number it reflects the strength of Pakistan’s economy, trade balance, and purchasing power. For individuals, businesses, and policymakers, tracking the dollar-to-rupee rate is critical to making financial decisions. Let’s break down the current 1 USD to PKR exchange rate, its historical journey, the factors influencing it, and what it means for everyday people.

Current USD to PKR Rate

As of mid-2025, 1 USD is trading around 281 to 283 PKR. The rate has shown small day-to-day fluctuations but has largely stabilized compared to the sharp swings seen in recent years. In the past week, the rupee has moved within a narrow range of 281.8 to 283.3, indicating that the currency is holding steady for now.

This stability comes after years of steep devaluation. Only a few years ago, the exchange rate hovered near 170 PKR per dollar, but economic challenges, global inflation, and local uncertainties pushed the rupee down to record lows.

Historical Overview

The Last Decade of Decline

- In 2017, the exchange rate was close to 105 PKR per USD.

- By 2020, during the pandemic, it had weakened to around 160–165 PKR per USD.

- In 2022–2023, political and economic crises drove it above 230 PKR per USD.

- By 2024, the rupee dropped further, touching almost 300 PKR per USD at certain points.

- Now in 2025, it is slightly more stable in the 281–283 PKR range.

This decade-long depreciation shows how the rupee has lost over 150% of its value compared to just eight years ago.

Why Does the USD to PKR Rate Fluctuate?

Several factors explain why the rupee loses or gains value:

- Trade Imbalances

Pakistan imports more goods than it exports, which increases the demand for dollars. When dollar demand rises, the rupee naturally loses value. - Foreign Debt and Loans

Pakistan relies heavily on external borrowing. Repaying debt in dollars creates constant pressure on the rupee. - Inflation

High inflation reduces the rupee’s purchasing power. Over the past few years, inflation in Pakistan has consistently been above 20%, eroding confidence in the currency. - Political Instability

Frequent changes in government and uncertain policies discourage foreign investment, which weakens the rupee. - Global Dollar Strength

A strong dollar internationally—driven by US interest rates and global demand—also hurts currencies like the PKR.

What It Means for Businesses and People

1. Remittances

Millions of overseas Pakistanis send money back home every year. A weaker rupee means families receive more PKR for every dollar, which is a short-term benefit.

2. Imports and Inflation

On the downside, businesses that import fuel, machinery, or raw materials must pay higher costs. This raises prices for ordinary consumers in the form of inflation.

3. Exports

A weaker rupee can make Pakistani exports like textiles and rice cheaper on the global market. However, the benefits are often offset by rising production costs inside Pakistan.

4. Investments

Unstable exchange rates discourage foreign investors. When the rupee keeps losing value, international businesses hesitate to enter the Pakistani market.

Government and Central Bank Measures

The State Bank of Pakistan (SBP) and the government have taken steps to stabilize the rupee:

- IMF Programs: Securing financial aid helps build dollar reserves.

- Import Restrictions: Limiting unnecessary imports reduces dollar demand.

- Monetary Policy: Keeping interest rates high attracts foreign inflows and discourages dollar hoarding.

- Market Reforms: Moves toward a more market-driven exchange rate have improved transparency.

These efforts have prevented the rupee from crossing further into the 300+ range in 2025, but long-term stability requires deeper economic reforms.

What to Expect in the Future

Looking ahead, the rupee’s stability depends on several key factors:

- Debt Repayments – Large foreign loan repayments in the coming months could put pressure on reserves.

- Political Stability – A stable government with consistent policies could strengthen investor confidence.

- Export Growth – Expanding export industries is the only sustainable way to reduce dollar dependence.

- Global Trends – Any strengthening of the US dollar globally could weaken the rupee further.

While short-term fluctuations will continue, most experts believe the rupee will stay in the 280–290 range for the near future.

Summary Table – USD to PKR

| Year | Rate (₨ per 1 USD) | Notes |

| 2017 | ~105 | Relatively stable |

| 2020 | ~160–165 | Pandemic pressure |

| 2022 | ~230+ | Political and economic crisis |

| 2024 | ~290–300 | Record low points |

| 2025 | ~281–283 | Stabilized but still very weak |

Final Thoughts

The story of the USD to PKR exchange rate reflects Pakistan’s broader economic challenges. While remittance earners and exporters may find short-term benefits, inflation, rising import costs, and weak investor confidence remain major concerns.

As of 2025, the rupee is holding steady compared to past volatility, but without long-term reforms in exports, governance, and fiscal management, the PKR will remain under pressure. For individuals and businesses alike, keeping an eye on dollar trends is essential to planning for the future.