North America Enterprise WLAN Market: Comprehensive Analysis and Future Outlook

Executive Summary

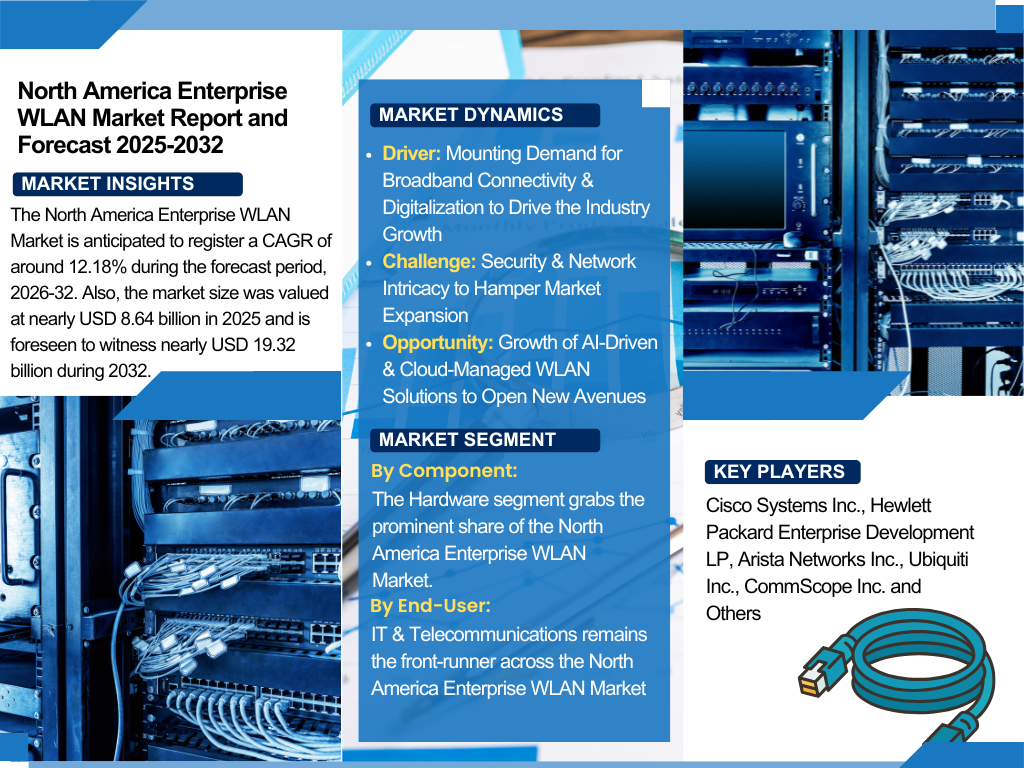

The North American enterprise wireless local area network (WLAN) market is experiencing unprecedented growth, driven by digital transformation initiatives and evolving workplace demands. With a projected compound annual growth rate (CAGR) of 12.18% from 2026 to 2032, the market is set to expand from USD 8.64 billion in 2025 to approximately USD 19.32 billion by 2032. This remarkable growth trajectory reflects the critical importance of robust wireless infrastructure in supporting modern business operations across various sectors.

Market Overview and Growth Drivers

The enterprise WLAN market in North America has emerged as a cornerstone of modern business infrastructure. Organizations are increasingly recognizing the vital role of high-performance wireless networks in enabling seamless connectivity across offices, campuses, and public institutions. The market’s expansion is fueled by several key factors that continue to reshape the business landscape.

Digital transformation initiatives have created an urgent demand for reliable broadband connectivity. As businesses embrace cloud services, Internet of Things (IoT) devices, and hybrid work models, the need for sophisticated WLAN infrastructure has intensified. Companies are investing heavily in advanced access points, controllers, and cloud-managed solutions to support high-density device environments and ensure seamless roaming capabilities.

The proliferation of mobile devices and the widespread adoption of Bring Your Own Device (BYOD) policies have further accelerated market growth. Modern enterprises must accommodate diverse device ecosystems while maintaining security standards and optimal performance levels. This complexity drives demand for intelligent network management systems capable of handling varied connectivity requirements.

Recent Market Developments

The enterprise WLAN landscape witnessed significant consolidation in 2025 with Hewlett Packard Enterprise’s USD 14 billion acquisition of Juniper Networks. Following successful navigation of Department of Justice antitrust proceedings with minimal concessions, this merger effectively doubled HPE’s networking business capabilities. The strategic combination strengthens HPE’s AI-driven cloud-native portfolio and positions the company as a formidable competitor to Cisco in the enterprise networking domain.

This consolidation reflects broader industry trends toward integrated solutions that combine hardware excellence with advanced software capabilities and comprehensive service offerings.

Market Dynamics and Challenges

Driving Forces

The mounting demand for reliable broadband connectivity serves as the primary catalyst for market expansion. Organizations require consistent, high-speed wireless access to support critical business operations, real-time collaboration, and data-intensive applications. The integration of IoT devices, cloud services, and hybrid work arrangements has created unprecedented connectivity requirements that traditional networking solutions cannot adequately address.

Key Challenges

Security concerns and network complexity present significant obstacles to market growth. As WLAN deployments expand, organizations face increasingly sophisticated cyber threats requiring comprehensive security measures. Managing multiple devices, implementing BYOD policies, and ensuring regulatory compliance while maintaining optimal performance creates substantial operational challenges for IT teams.

The complexity of managing numerous access points, coordinating firmware updates, and implementing AI-enabled analytics often strains internal resources. This challenge has generated increased demand for managed services and unified network management platforms that can simplify operations while enhancing security postures.

Emerging Opportunities

The adoption of AI-driven and cloud-managed WLAN solutions presents substantial growth opportunities. These advanced platforms automate network optimization, enable predictive issue detection, and streamline security policy implementation. By reducing operational burdens while improving network reliability, these solutions align with organizational goals for increased agility and cost efficiency.

Cloud-managed systems particularly appeal to businesses seeking scalable, flexible infrastructure that can adapt to changing requirements without significant capital investments. The shift toward intelligent, automated network management represents a fundamental transformation in how enterprises approach wireless connectivity.

Technological Trends Shaping the Market

Wi-Fi 7 Adoption

The rollout of Wi-Fi 7 technology represents a significant advancement in wireless networking capabilities. This latest standard delivers unprecedented speeds, reduced latency, and more efficient spectrum utilization—characteristics essential for supporting modern enterprise environments. Organizations are increasingly investing in Wi-Fi 7-compatible infrastructure to future-proof their wireless networks and accommodate evolving connectivity demands.

IoT Integration and BYOD Proliferation

The exponential growth of IoT devices and sensors in workplace environments continues to challenge existing WLAN infrastructure. Smart building systems, industrial sensors, and connected equipment require reliable, secure connectivity that can scale with organizational needs. Simultaneously, BYOD policies necessitate network solutions capable of managing diverse device types while maintaining security standards.

These trends drive demand for high-performance, scalable WLAN solutions with intelligent management capabilities that can adapt to changing device landscapes and connectivity requirements.

Market Segmentation Analysis

Component-Based Segmentation

The hardware segment maintains its dominant position in the North American enterprise WLAN market, serving as the foundational layer for all wireless networking deployments. Routers, access points, gateways, and controllers form the critical physical infrastructure enabling high-speed wireless connectivity in corporate environments.

As organizations transition to hybrid work models and accommodate increasing device density, demand for high-performance, secure hardware solutions has intensified. Vendors continuously innovate with multi-band technologies, beam-forming capabilities, and integrated security features to meet evolving industry requirements. Wi-Fi 6, 6E, and 7-ready hardware particularly attracts enterprise investment as organizations seek to future-proof their wireless infrastructure.

Software solutions complement hardware deployments by providing AI-driven network management and enhanced security capabilities. These platforms enable centralized control, automated optimization, and comprehensive analytics that improve operational efficiency and network performance.

Services, particularly managed services, are experiencing rapid growth as organizations seek specialized expertise to optimize their wireless infrastructure. Outsourced management allows companies to leverage professional skills while focusing internal resources on core business activities.

End-Use Industry Analysis

The IT and telecommunications sector leads the North American enterprise WLAN market, capturing the largest market share. This dominance reflects the sector’s tremendous infrastructure requirements for supporting network operations, mobile workforces, cloud services, and extensive device ecosystems.

IT and telecommunications organizations demonstrate the highest WLAN service utilization due to their high-capacity deployment needs, frequent data exchanges, and critical uptime requirements. As digital transformation accelerates through edge computing, software-defined wide area networking (SD-WAN), and AI-based networking solutions, this vertical’s dependence on sophisticated WLAN infrastructure continues to grow.

Other significant sectors include banking, financial services, and insurance (BFSI), healthcare, and retail. Each industry presents unique connectivity requirements that drive specialized WLAN solution development and implementation.

Geographic Market Distribution

United States Market Leadership

The United States maintains its position as the primary contributor to the North American enterprise WLAN market, accounting for the majority of market share. The country’s advanced digital infrastructure, extensive cloud and AI technology adoption, and substantial enterprise base drive continued investment in wireless networking solutions.

Demand for enterprise WLAN solutions demonstrates particular strength across finance, education, healthcare, and government sectors, where high-performance, secure wireless connectivity is mission-critical. Strategic investments in phased Wi-Fi 6E and Wi-Fi 7 rollouts, network densification initiatives, and intelligent WLAN management systems further strengthen the United States’ market leadership position.

Canadian Market Development

Canada represents a significant growth opportunity within the North American market, driven by increasing digital transformation initiatives and evolving workplace connectivity requirements. Canadian organizations are investing in modernized wireless infrastructure to support hybrid work models and accommodate growing device populations.

Future Outlook and Strategic Implications

The North American enterprise WLAN market is positioned for sustained innovation and growth through 2032. Key trends driving future development include the continued migration toward cloud-managed WLAN systems, integration of artificial intelligence for network optimization, and enhanced cybersecurity standards to address evolving threat landscapes.

Organizations are increasingly prioritizing next-generation wireless infrastructure capable of supporting hybrid work models, dense device environments, and latency-sensitive applications. The convergence of 5G and Wi-Fi technologies will create new opportunities for seamless connectivity across different network types and use cases.

Digital transformation initiatives, enterprise agility demands, and continuous technological evolution will continue driving market expansion. The integration of AI-driven operations, advanced 5G and Wi-Fi deployments, and comprehensive cybersecurity frameworks will establish enterprise WLAN as an indispensable backbone for modern organizations.

Conclusion

The North American enterprise WLAN market represents a dynamic, rapidly evolving sector critical to modern business success. With robust growth projections, continuous technological advancement, and expanding application areas, the market offers significant opportunities for vendors, service providers, and end-users alike.

Success in this competitive landscape requires understanding complex organizational needs, delivering integrated solutions that combine hardware excellence with intelligent software capabilities, and providing comprehensive services that simplify network management while enhancing security and performance. As businesses continue embracing digital transformation and hybrid work models, enterprise WLAN infrastructure will remain fundamental to organizational success and competitiveness.

The market’s future depends on continued innovation in areas such as AI-driven network management, enhanced security frameworks, and seamless integration with emerging technologies. Organizations that invest strategically in advanced WLAN infrastructure today will be best positioned to capitalize on future opportunities and maintain competitive advantages in an increasingly connected business environment.