Real Estate Tips to Buy, Sell, and Invest Smartly

Buying, selling, or investing in real estate can feel intimidating, but with the right approach, you can make confident decisions that align with your financial goals. The market may shift, but the principles of good buying and orion vapes selling remain consistent if you know what to watch for. You do not need to rush; taking steady steps will help you avoid overpaying or underselling your property. Understanding current market trends, neighborhood developments, and your financing options can set you up for long-term success. This guide will help you move forward in your real estate journey with clear, practical insights you can apply immediately.

Understanding the Current Market

Research Local Market Data

Before you make any move, study the local housing trends:

- Check recent sale prices in your target area to understand current pricing.

- Monitor inventory levels; fewer homes available may signal a seller’s market.

- Pay attention to average days on the market to gauge demand.

- Consider employment growth and infrastructure projects in the area.

- Visit open houses to get a realistic sense of the properties within your budget.

Set Your Budget Smartly

Financial readiness is essential whether you are buying, selling, or investing:

- Calculate how much you can afford based on your income, debts, and living expenses.

- Get pre-approved for a mortgage before house hunting.

- Account for additional costs such as closing fees, taxes, and maintenance.

- For sellers, factor in agent commissions and minor improvements to boost appeal.

- Investors should include potential renovation costs and property management fees in projections.

Leverage Professional Guidance

While it is possible to buy or sell independently, working with a professional can make your journey smoother:

- Realtors have local knowledge and negotiation skills to help secure favorable deals.

- A reliable inspector will help identify any hidden issues in a property before you commit.

- Mortgage advisors can help you find the best financing options aligned with your financial plans.

- Property managers are valuable for investors planning to rent out their properties.

- Seek recommendations from friends, family, or online reviews to find trusted professionals.

Buying Property with Long-Term Vision

Identify Your Goals Clearly

Before you begin, clarify why you are buying:

- Is this your primary residence, a rental property, or a vacation home?

- Do you plan to live there long-term, or is it a stepping-stone investment?

- Are you seeking cash flow, appreciation, or both if buying as an investor?

- Understanding your “why” will shape your choices and location priorities.

- Be realistic about the type of property and neighborhood that aligns with your goals.

Evaluate Location with Practical Parameters

The location often determines future value and lifestyle convenience:

- Proximity to schools, workplaces, healthcare, and public transport increases desirability.

- Assess neighborhood safety, development plans, and community amenities.

- Look at potential for infrastructure improvements, parks, and shopping areas.

- Track rental demand and vacancy rates if you are investing in rental property.

- Understand zoning regulations that may affect future modifications or usage.

Incorporate Modern Lifestyle Trends

Buyers today consider connectivity and lifestyle convenience essential:

- Smart home readiness and high-speed internet access attract modern buyers.

- Functional home offices are valuable in today’s hybrid work environment.

- Energy-efficient appliances and design can lower utility costs and appeal to eco-conscious buyers.

- Outdoor spaces and wellness-focused amenities are increasingly sought after.

- Properties near emerging business hubs often show strong appreciation potential.

In the middle of your planning, remember to consider Orion bar vape shops or lifestyle convenience stores near your potential property, as such emerging retail trends can increase neighborhood vibrancy and foot traffic, positively affecting property demand over time.

Selling Property with Strategy

Present Your Property Effectively

When selling, presentation impacts your sale price and time on the market:

- Declutter and deep-clean the property to create a welcoming environment.

- Neutral paint colors and simple décor allow buyers to visualize the space.

- Minor repairs (leaking faucets, cracked tiles) can prevent buyer objections.

- Enhance curb appeal with clean landscaping and tidy entryways.

- Consider professional photography to showcase your property online.

Price Realistically Based on Data

A fair, data-backed price helps your property attract serious buyers quickly:

- Review comparative market analysis (CMA) from your realtor.

- Avoid pricing too high, which can lead to your property sitting idle.

- Monitor buyer interest and feedback during the first few weeks.

- Adjust pricing if needed to match market conditions.

- Competitive pricing paired with a well-presented home can lead to multiple offers.

Negotiate with a Collaborative Mindset

Negotiation does not have to feel adversarial:

- Understand the buyer’s perspective and priorities.

- Be clear about your non-negotiables, such as your bottom price.

- Consider offering minor concessions like closing cost assistance if it benefits your timeline.

- Stay flexible to inspection and repair requests that are reasonable.

- Keep communication open and professional to maintain momentum toward closing.

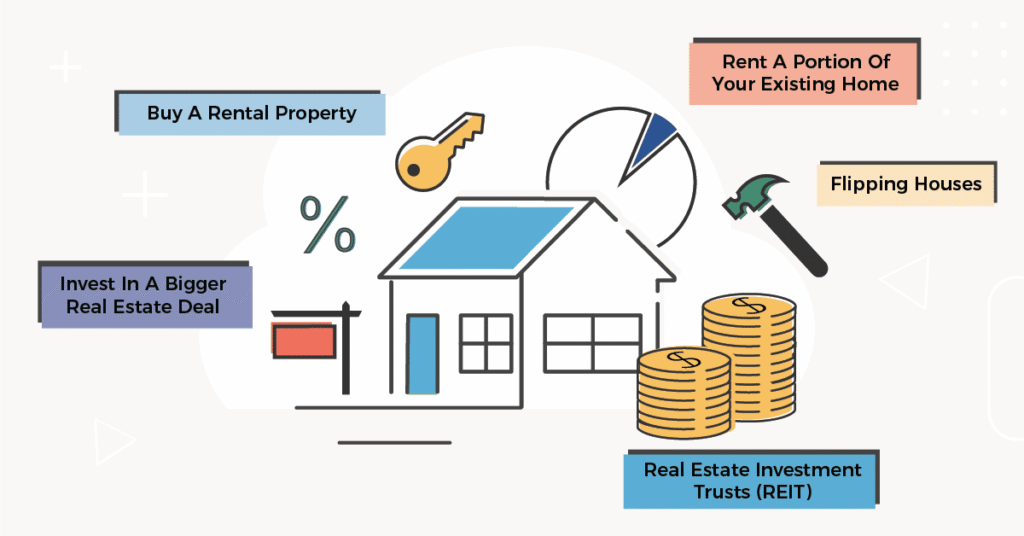

Smart Investing for Consistent Growth

Focus on Cash Flow and Appreciation Balance

A wise investment strategy blends consistent cash flow with potential appreciation:

- Properties in stable, growing neighborhoods may yield steady rental income.

- Look for areas with upcoming infrastructure or business developments.

- Balance your portfolio with different property types if expanding your investments.

- Evaluate historical appreciation trends to project future potential.

- Consider local rental demand, regulations, and property management capabilities.

Monitor Market Trends Regularly

Real estate investment requires ongoing awareness:

- Track interest rate changes that affect your financing and ROI.

- Stay updated on local economic conditions influencing rental demand.

- Evaluate property maintenance regularly to protect your investment value.

- Network with other investors to exchange market insights.

- Consider attending local real estate meetups or online webinars to remain informed.

Think Long-Term

Successful investors plan beyond immediate returns:

- Choose properties that align with your financial goals and risk tolerance.

- Reinvest rental income to grow your portfolio over time.

- Build strong relationships with reliable contractors and property managers.

- Maintain reserves for unexpected repairs or market fluctuations.

- Review your investment strategy annually to adjust for market shifts and personal goals.

If you’re planning your next move, remember that even lifestyle choices, such as selecting a Orion bar vape flavors for your relaxation breaks during your property visits, reflect the importance of balancing convenience and practicality in your investing journey.